- December 13th, 2021

- Category:

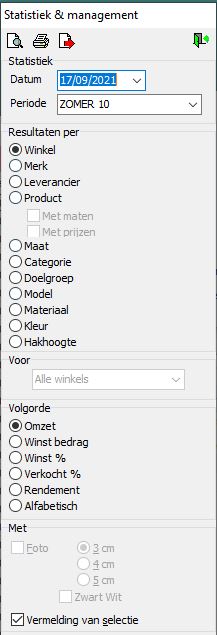

GemShop - Reports

What exactly will change for your webshop on 1 July 2021? We list the most important changes for you.

As of July 1, each state will have the same turnover threshold. In concrete terms, this means the following:

- Turnover < 10.000 EUR in other member states:

If you sell via your e-commerce to another Member State and this turnover does not exceed EUR 10,000 then you have the choice of applying your own Belgian VAT rules or immediately the local VAT rules of the Member State of the customers you sell to. For example, if you have customers from France in your web shop. Then you can either apply the Belgian VAT rules or the French if the turnover you obtain from EU member states on an annual basis is no more than EUR 10,000.

- Turnover > EUR 10,000 in other Member States:

If you sell for more than EUR 10,000 per year through your e-commerce to customers located in another Member State, then you must apply the local VAT rates. It is therefore important to keep a close eye on when the turnover threshold of EUR 10,000 within another Member State will be exceeded. Of course, you can immediately opt to apply the local VAT rules.

Administrative simplification

At first glance, the various local VAT rules may seem a daunting task. That is why the European Union has drastically simplified the declaration and payment of VAT by means of a One Stop Shop system for all intra-community VAT. All VAT declarations for the supply of goods and digital services in the entire EU can be included in the Belgian VAT declaration from 1 July onwards. This means that local declarations and payments will no longer have to be made.

Of course you are wondering how to get your webshop ready for these new regulations.

Here is a step-by-step plan:

- Map out in which countries your customers live and in which countries you generate turnover;

- Find out per country how much turnover you generate or aim to generate;

- Check which VAT rates apply to each country;

- Determine which VAT rates you want (for turnover threshold < 10 000 EUR) or must (for turnover threshold > 10 000 EUR) apply;

- Ensure correct price labeling, including VAT, for the products and online services you offer (via cookies based on location or entered address details);

- Adjust your prices or settings in your ads, Google shopping feeds, Instagram catalogs and all other channels where you post prices.